v. Dependant on these assumptions, the every month payment for the non-typical home finance loan for uses of figuring out if the regular mortgage month to month payment is decrease as opposed to non-typical home loan monthly payment (

If you intend to make or ask for this sort of loan, monetary planners endorse Placing loan terms and repayment strategies in creating, and paying out fascination if at all possible.

Charge card rates might be preset or variable. Charge card issuers usually are not needed to give Superior recognize of the fascination fee increase for charge cards with variable curiosity fees. It is achievable for borrowers with superb credit score to ask for far more favorable prices on their own variable loans or bank cards.

It can save you revenue in curiosity. In case you’re battling superior-interest charge card credit card debt, getting out a personal debt consolidation loan could help save you masses — if not thousands of pounds worth of desire, based upon your rate.

For groups with a share Restrict, the creditor need to implement the allowable details and costs proportion to your “whole loan volume,” which can be distinct as opposed to loan volume. A creditor should calculate the allowable level of points and fees for a qualified house loan as follows:

iii. Assume that the topic property is found in a region where by flood coverage is necessary by Federal legislation, and think even more which the flood insurance policy premium is paid out every three a long time subsequent consummation. The creditor complies with § 1026.

Daily life insurance guideLife insurance policy ratesLife insurance policy insurance policies and coverageLife insurance policy quotesLife insurance coverage reviewsBest daily life insurance policy companiesLife insurance policies calculator

Elias is The purpose human being for that loans sub-vertical and functions with the editorial workforce to make certain all charges and data for private and college student loans are up-to-day and exact.He joined Insider in February 2022 for a fellow around the compliance workforce. Examine far more

Bankrate.com can be an impartial, marketing-supported publisher and comparison assistance. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain inbound links posted on our site. Hence, this compensation may affect how, where As well as in what buy merchandise surface inside listing classes, except exactly where prohibited by regulation for our mortgage, home equity along with other dwelling lending goods. Other elements, including our very own proprietary Web page policies and regardless of whether a product is offered in your area or at your self-picked credit rating score array, can also influence how and wherever solutions show up on This website. While we strive to offer an array of offers, Bankrate does not consist of specifics of just about every economic or credit rating products or services.

In accordance with the National Credit history Union Administration, payday different loans usually vary from $200 to $1,000 and possess conditions in between just one and 6 months. Check with all your credit union to find out if this feature is out there, and what interest rates and borrowing amounts are available.

An amortization routine allows reveal the particular amount of money that 43 cash loan should be paid out in direction of Each and every, together with the fascination and principal compensated to this point, and also the remaining principal stability right after Each individual pay period.

two. Cash flow or belongings relied on. A creditor require contemplate just the income or assets important to assist a willpower that The patron can repay the protected transaction. As an example, if a client's loan application states that the consumer earns an yearly salary from both a complete-time occupation and a part-time job plus the creditor moderately determines that the consumer's revenue through the full-time work is enough to repay the loan, the creditor needn't consider the client's earnings from the element-time position.

It can be worth noting that When you've got an unexpected emergency fund or cash price savings, dipping into These assets is an improved possibility than borrowing. If you have to borrow funds within an crisis, There are some other avenues to examine.

The utmost fascination charge throughout the 1st five years following the date on which the 1st common periodic payment will probably be because of is ten %.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! James Van Der Beek Then & Now!

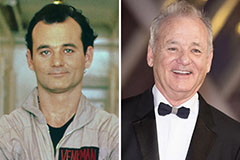

James Van Der Beek Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!